第一章 单元测试

1、单选题:

The Bluebird Company has a $10,000 liability it must pay three years from today.

The company is opening a savings account so that the entire amount will be available when this debt needs to be paid. The plan is to make an initial deposit today and then deposit an additional $2,500 a year for the next three years, starting one year from today. The account pays a 3% rate of return. How much does the Bluebird Company need to deposit today? ( )

选项:

A:$4,276.34

B:$3,108.09

C:$1,867.74

D:$2,079.89

答案: 【$2,079.89

】

2、单选题:

Suzette is going to receive $10,000 today as the result of an insurance settlement. In addition, she will receive $15,000 one year from today and $25,000 two years from today. She plans on saving all of this money and investing it for her retirement. If Suzette can earn an average of 11% on her investments, how much will she have in her account if she retires 25 years from today? ( )

选项:

A:$595,098.67

B:$546,072.91

C:$536,124.93

D:$541,414.14

答案: 【$595,098.67

】

3、单选题:

You are investing $100 today in a savings account at your local bank. Which one of the following terms refers to the value of this investment one year from now? ( )

选项:

A:discounted value

B:present value

C:principal amounts

D:future value

答案: 【future value

】

4、单选题:

Sara invested $500 six years ago at 5 percent interest. She spends her earnings as soon as she earns any interest so she only receives interest on her initial $500 investment. Which type of interest is Sara earning?

选项:

A:complex interest

B:simple interest

C:interest on interest

D:free interest

答案: 【simple interest】

5、单选题:

Shelley won a lottery and will receive $1,000 a year for the next ten years. The value of her winnings today discounted at her discount rate is called which one of the following? ( )

选项:

A:present value

B:simple amount

C:future value

D:single amount

答案: 【present value

】

6、单选题:

Which one of the following will produce the highest present value interest factor? ( )

选项:

A:8 percent interest for five years

B:6 percent interest for eight years

C:6 percent interest for ten years

D:6 percent interest for five years

答案: 【6 percent interest for five years

】

7、单选题:

Which one of the following terms is defined as a conflict of interest between the corporate shareholders and the corporate managers? ( )

选项:

A:agency problem

B:corporate breakdown

C:bylaws

D:articles of incorporation

答案: 【agency problem

】

8、单选题:

Which one of the following is a capital budgeting decision? ( )

选项:

A:deciding whether or not to purchase a new machine for the production line

B:deciding how to refinance a debt issue that is maturing

C:determining how much inventory to keep on hand

D:determining how many shares of stock to issue

答案: 【deciding whether or not to purchase a new machine for the production line

】

9、多选题:

Which of the following questions are addressed by financial managers? ( )

选项:

A:Should the firm borrow more money?

B:Should customers be given 30 or 45 days to pay for their credit purchases?

C:Should the firm acquire new equipment?

D:How should a product be marketed?

答案: 【Should the firm borrow more money?

;Should customers be given 30 or 45 days to pay for their credit purchases?

;Should the firm acquire new equipment?

】

10、多选题:

Which of the following should a financial manager consider when analyzing a capital budgeting project? ( )

选项:

A:project start up costs

B:dependability of future cash flows

C:dollar amount of each projected cash flow

D:timing of all projected cash flows

答案: 【project start up costs

;dependability of future cash flows

;dollar amount of each projected cash flow

;timing of all projected cash flows

】

第二章 单元测试

1、单选题:

The formula which breaks down the return on equity into three component parts is referred to as which one of the following? ( )

选项:

A:Du Pont identity

B:equity equation

C:SIC formula

D:profitability determinant

答案: 【Du Pont identity

】

2、单选题:

A firm uses 2008 as the base year for its financial statements. The common-size, base-year statement for 2009 has an inventory value of 1.08. This is interpreted to mean that the 2009 inventory is equal to 108 percent of which one of the following? ( )

选项:

A:2008 inventory

B:2009 total assets

C:2008 total assets

D:2008 inventory expressed as a percent of 2008 total assets

答案: 【2008 inventory expressed as a percent of 2008 total assets

】

3、单选题:

If a firm has a debt-equity ratio of 1.0, then its total debt ratio must be which one of the following? ( )

选项:

A:0.0

B:1.0

C:1.5

D:0.5

答案: 【0.5

】

4、单选题:

Which one of the following will decrease if a firm can decrease its operating costs, all else constant? ( )

选项:

A:profit margin

B:return on assets

C:return on equity

D:price-earnings ratio

答案: 【price-earnings ratio

】

5、单选题:

During the year, Kitchen Supply increased its accounts receivable by $130, decreased its inventory by $75, and decreased its accounts payable by $40. How did these three accounts affect the firm’s cash flows for the year? ( )

选项:

A:$165 use of cash

B:$245 use of cash

C:$95 source of cash

D:$95 use of cash

答案: 【$95 use of cash

】

6、单选题:

A firm generated net income of $878. The depreciation expense was $47 and dividends were paid in the amount of $25. Accounts payables decreased by $13, accounts receivables increased by $22, inventory decreased by $14, and net fixed assets decreased by $8. There was no interest expense. What was the net cash flow from operating activity? ( )

选项:

A:$876

B:$904

C:$902

D:$922

答案: 【$904

】

7、单选题:

The Bike Shop paid $2,310 in interest and $1,850 in dividends last year. The times interest earned ratio is 2.2 and the depreciation expense is $460. What is the value of the cash coverage ratio? ( )

选项:

A:2.21

B:2.40

C:1.67

D:1.80

答案: 【2.40

】

8、单选题:

Canine Supply has sales of $2,200, total assets of $1,400, and a debt-equity ratio of 0.3. Its return on equity is 15 percent. What is the net income? ( )

选项:

A:$152.09

B:$156.67

C:$141.41

D:$138.16

E:$161.54

答案: 【$161.54

】

9、单选题:

Which one of the following terms is applied to the financial planning method which uses the projected sales level as the basis for determining changes in balance sheet and income statement account values? ( )

选项:

A:common-size method

B:sales reconciliation method

C:percentage of sales method

D:sales dilution method

答案: 【percentage of sales method

】

10、单选题:

Financial planning: ( )

选项:

A:is a process that firms employ only when major changes to a firm’s operations are anticipated.

B:is a process that firms undergo once every five years.

C:focuses solely on the short-term outlook for a firm.

D:considers multiple options and scenarios for the next two to five years.

答案: 【considers multiple options and scenarios for the next two to five years.

】

11、单选题:

A firm is currently operating at full capacity. Net working capital, costs, and all assets vary directly with sales. The firm does not wish to obtain any additional equity financing. The dividend payout ratio is constant at 40 percent. If the firm has a positive external financing need, that need will be met by: ( )

选项:

A:fixed assets.

B:accounts payable.

C:retained earnings.

D:long-term debt.

答案: 【long-term debt.

】

12、单选题:

Which one of the following will cause the sustainable growth rate to equal to internal growth rate? ( )

选项:

A:debt-equity ratio of 1.0

B:dividend payout ratio greater than 1.0

C:equity multiplier of 1.0

D:retention ratio between 0.0 and 1.0

答案: 【equity multiplier of 1.0

】

13、单选题:

A firm has a retention ratio of 45 percent and a sustainable growth rate of 6.2 percent. The capital intensity ratio is 1.2 and the debt-equity ratio is 0.64. What is the profit margin? ( )

选项:

A:6.28 percent

B:9.47 percent

C:7.67 percent

D:14.63 percent

答案: 【14.63 percent

】

14、单选题:

The Soccer Shoppe has a 7 percent return on assets and a 25 percent payout ratio. What is its internal growth rate? ( )

选项:

A:5.54 percent

B:3.72 percent

C:4.49 percent

D:4.08 percent

答案: 【5.54 percent

】

15、多选题:

An increase in which of the following will increase the return on equity, all else constant?( )

选项:

A:depreciation

B:net income

C:sales

D:total equity

答案: 【net income

;sales

】

第三章 单元测试

1、单选题:

Accepting positive NPV projects benefits the stockholders because: ( )。

选项:

A:it is the most easily understood valuation process.

B:the present value of the expected cash flows are equal to the cost.

C:it is the most easily calculated.

D:the present value of the expected cash flows are greater than the cost.

答案: 【the present value of the expected cash flows are greater than the cost.

】

2、单选题:

The payback period rule: ( )。

选项:

A:always uses all possible cash flows in its calculation.

B:The cash flow after the payback period is ignored.

C:ignores initial cost.

D:discounts cash flows.

答案: 【The cash flow after the payback period is ignored.】

3、单选题:

A project will have more than one IRR if: ( )。

选项:

A:the NPV is zero.

B:the cash flow pattern exhibits more than one sign change.

C:the IRR is positive.

D:the IRR is negative.

答案: 【the cash flow pattern exhibits more than one sign change.

】

4、单选题:

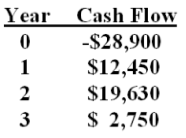

What is the net present value of a project with the following cash flows and a required return of 12%?

选项:

A:$177.62

B:-$287.22

C:$204.36

D:-$177.62

答案: 【-$177.62】

5、单选题:

The length of time required for a project’s discounted cash flows to equal the initial cost of the project is called the: ( )

选项:

A:

internal rate of return

B:

discounted payback period

C:

net present value

D:

payback period

答案: 【

discounted payback period

】

第四章 单元测试

1、单选题:

Jamestown Ltd. currently produces boat sails and is considering expanding its operations to include awnings for homes and travel trailers. The company owns land beside its current manufacturing facility that could be used for the expansion. The company bought this land ten years ago at a cost of $250,000. Today, the land is valued at $425,000. The grading and excavation work necessary to build on the land will cost $15,000. The company currently owns some unused equipment valued at $60,000. This equipment could be used for producing awnings if $5,000 is spent for equipment modifications. Other equipment costing $780,000 will also be required. What is the amount of the initial cash flow for this expansion project? ( )。

选项:

A:$1,110,000

B:$800,000

C:$1,285,000

D:$1,050,000

答案: 【$1,285,000

】

2、单选题:

Walks Softly, Inc. sells customized shoes. Currently, it sells 10,000 pairs of shoes annually at an average price of $68 a pair. It is considering adding a lower-priced line of shoes which sell for $49 a pair. Walks Softly estimates it can sell 5,000 pairs of the lower-priced shoes but will sell 1,000 less pairs of the higher-priced shoes by doing so. What is the amount of the sales that should be used when evaluating the addition of the lower-priced shoes? ( )。

选项:

A:$789,000

B:$245,000

C:$177,000

D:$313,000

答案: 【$177,000

】

3、单选题:

Jamie’s Motor Home Sales currently sells 1,000 Class A motor homes, 2,500 Class C motor homes, and 4,000 pop-up trailers each year. Jamie is considering adding a mid-range camper and expects that if she does so she can sell 1,500 of them. However, if the new camper is added, Jamie expects that her Class A sales will decline to 950 units while the Class C campers decline to 2,200. The sales of pop-ups will not be affected. Class A motor homes sell for an average of $125,000 each. Class C homes are priced at $39,500 and the pop-ups sell for $5,000 each. The new mid-range camper will sell for $47,900. What is the erosion cost? ( )。

选项:

A:$93,150,000

B:$18,100,000

C:$6,250,000

D:$53,750,000

答案: 【$18,100,000

】

4、单选题:

Ernie’s Electrical is evaluating a project which will increase sales by $50,000 and costs by $30,000. The project will cost $150,000 and will be depreciated straight-line to a zero book value over the 10 year life of the project. The applicable tax rate is 34%. What is the operating cash flow for this project? ( )。

选项:

A:$3,300

B:$5,000

C:$8,300

D:$18,300

答案: 【$18,300

】

5、单选题:

Ben’s Border Café is considering a project which will produce sales of $16,000 and increase cash expenses by $10,000. If the project is implemented, taxes will increase from $23,000 to $24,500 and depreciation will increase from $4,000 to $5,500. What is the amount of the operating cash flow using the top-down approach? ( )。

选项:

A:$4,000

B:$7,500

C:$6,000

D:$4,500

答案: 【$4,500

】

6、单选题:

Scenario analysis is defined as the: ( )

选项:

A:isolation of the effect that a single variable has on the NPV of a project.

B:separation of a project’s sunk costs from its opportunity costs.

C:determination of changes in NPV estimates when what-if questions are posed.

D:determination of the initial cash outlay required to implement a project.

答案: 【determination of changes in NPV estimates when what-if questions are posed.

】

7、单选题:

An analysis of the change in a project’s NPV when a single variable is changed is called _____ analysis. ( )

选项:

A:sensitivity

B:scenario

C:simulation

D:forecasting

答案: 【sensitivity

】

8、单选题:

An analysis which combines scenario analysis with sensitivity analysis is called _____ analysis. ( )

选项:

A:forecasting

B:simulation

C:combined

D:complex

答案: 【simulation

】

9、单选题:

By definition, which one of the following must equal zero at the accounting break-even point? ( )

选项:

A:contribution margin

B:internal rate of return

C:net income

D:net present value

答案: 【net income

】

10、单选题:

By definition, which one of the following must equal zero at the cash break-even point? ( )

选项:

A:operating cash flow

B:internal rate of return

C:net present value

D:net income

答案: 【operating cash flow

】

11、单选题:

Which one of the following is defined as the sales level that corresponds to a zero NPV? ( )

选项:

A:accounting break-even

B:cash break-even

C:financial break-even

D:marginal break-even

答案: 【financial break-even

】

12、多选题:

following changes that she is considering will help that project produce a positive NPV instead? Consider each change independently.( )

选项:

A:increase the quantity sold

B:decrease the fixed leasing cost for equipment

C:increase the sales price

D:decrease the labor hours needed to produce one unit

答案: 【increase the quantity sold

;decrease the fixed leasing cost for equipment

;increase the sales price

;decrease the labor hours needed to produce one unit

】

第五章 单元测试

1、单选题:

Mary just purchased a bond which pays $60 a year in interest. What is this $60 called? ( )

选项:

A:face value

B:call premium

C:coupon

D:discount

答案: 【coupon

】

2、单选题:

The current yield is defined as the annual interest on a bond divided by which one of the following? ( )

选项:

A:market price

B:face value

C:coupon

D:dirty price

答案: 【market price

】

3、单选题:

The specified date on which the principal amount of a bond is payable is referred to as which one of the following? ( )

选项:

A:coupon date

B:dirty date

C:maturity

D:yield date

答案: 【maturity

】

4、单选题:

A bond is quoted at a price of $989. This price is referred to as which one of the following? ( )

选项:

A:face value

B:dirty price

C:clean price

D:call price

答案: 【clean price

】

5、单选题:

The Walthers Company has a semi-annual coupon bond outstanding. An increase in the market rate of interest will have which one of the following effects on this bond? ( )

选项:

A:increase the coupon rate

B:increase the market price

C:decrease the coupon rate

D:decrease the market price

答案: 【decrease the market price

】

6、单选题:

The common stock of Eddie’s Engines, Inc. sells for $25.71 a share. The stock is expected to pay $1.80 per share next month when the annual dividend is distributed. Eddie’s has established a pattern of increasing its dividends by 4% annually and expects to continue doing so. What is the market rate of return on this stock? ( )。

选项:

A:7%

B:13%

C:9%

D:11%

答案: 【11%

】

7、单选题:

Shares of common stock of the Samson Co. offer an expected total return of 12%. The dividend is increasing at a constant 8% per year. The dividend yield must be: ( )。

选项:

A:12%.

B:8%.

C:4%.

D:-4%.

答案: 【8%.

】

8、单选题:

Wilbert’s Clothing Stores just paid a $1.20 annual dividend. The company has a policy whereby the dividend increases by 2.5% annually. You would like to purchase 100 shares of stock in this firm but realize that you will not have the funds to do so for another three years. If you desire a 10% rate of return, how much should you expect to pay for 100 shares when you can afford to buy this stock? Ignore trading costs. ( )。

选项:

A:$1,766

B:$1,640

C:$1,681

D:$1,723

答案: 【$1,766

】

9、单选题:

Last week, Railway Cabooses paid its annual dividend of $1.20 per share. The company has been reducing the dividends by 10% each year. How much are you willing to pay to purchase stock in this company if your required rate of return is 14%? ( )。

选项:

A:$15.60

B:$7.71

C:$4.50

D:$10.80

答案: 【$4.50

】

10、单选题:

Which of the following amounts is closest to what should be paid for Overland common stock? Overland has just paid a dividend of $2.25. These dividends are expected to grow at a rate of 5% in the foreseeable future. The required rate of return is 11%. ( )。

选项:

A:$39.38

B:$21.48

C:$37.50

D:$20.45

答案: 【$39.38

】

11、多选题:

A bond has a market price that exceeds its face value. Which of the following features currently apply to this bond? ( )

选项:

A:yield-to-maturity that exceeds the coupon rate

B:yield-to-maturity that is less than the coupon rate

C:premium price

D:discounted price

答案: 【yield-to-maturity that is less than the coupon rate

;premium price

】

12、多选题:

Which of the following relationships apply to a par value bond? ( )

选项:

A:market price = call price

B:current yield = yield-to-maturity

C:market price = face value

D:coupon rate < yield-to-maturity

答案: 【current yield = yield-to-maturity

;market price = face value

】

第六章 单元测试

1、单选题:

根据CAPM模型,贝塔值为1.0,阿尔法值为0的资产组合预期收益率为:( )

选项:

A:β(rM—rf)

B:市场预期收益率rM

C:无风险利率rf

D:在rM和rf之间

答案: 【市场预期收益率rM

】

2、单选题:

某个证券的市场风险贝塔,等于( ) 。

选项:

A:该证券收益与市场收益的协方差除以市场收益的标准差

B:该证券收益的方差除以它与市场收益的协方差

C:该证券收益的方差除以市场收益的方差

D:该证券收益与市场收益的协方差除以市场收益的方差

答案: 【该证券收益与市场收益的协方差除以市场收益的方差

】

3、单选题:

证券市场线是( )。

选项:

A:也叫资本市场线

B:表示出了期望收益与贝塔关系的线

C:对充分分散化的资产组合,描述期望收益与贝塔的关系

D:与所有风险资产有效边界相切的线

答案: 【表示出了期望收益与贝塔关系的线

】

4、单选题:

你投资了600美元于证券A,其贝塔值为1. 2;投资400美元于证券B,其贝塔值为-0. 20。资产组合的贝塔值为 ( )。

选项:

A:0.36

B:1.40

C:1.00

D:0.64

答案: 【0.64

】

5、单选题:

有两个模型,其中 描述了所有资产都遵循的期望收益率-贝塔值之间的关系, 则提出这个关系仅有少量证券不遵守,其余大多数仍是成立的。( )

选项:

A:CAPM, APT

B:APT, CAPM

C:APT, OPM

D:CAPM, OPM

答案: 【CAPM, APT

】

6、单选题:

套利定价理论中,一个充分分散风险的资产组合,组成证券数目越多,非系统风险就越接近( ) 。

选项:

A:0

B:-1

C:1

D:无穷大

答案: 【0

】

7、单选题:

考虑多因素 APT模型。因素组合1和因素组合2的风险溢价分别为5%和3%。无风险利率为10%。股票 A的期望收益率为19%,对因素1的贝塔值为0.8。那么股票A对因素2的贝塔值为( )。

选项:

A:2.00

B:1.67

C:1.5

D:1.33

答案: 【1.67

】

8、单选题:

哪个模型没有说明如何确定因素资产组合的风险溢价? ( )

选项:

A:CAPM

B:多因素APT

C:CAPM和多因素APT

D:CAPM和多因素APT都不是

答案: 【多因素APT

】

9、单选题:

与CAPM模型相比,套利定价理论:( )

选项:

A:指明数量并确定那些能够决定期望收益率的特定因素。

B:不要求关于市场资产组合的限制性假定

C:要求市场均衡。

D:使用以微观变量为基础的风险溢价。

答案: 【不要求关于市场资产组合的限制性假定

】

10、单选题:

关于资本市场线,哪种说法不正确?( )

选项:

A:资本市场线也叫作证券市场线

B:资本市场线斜率总为正

C:资本市场线通过无风险利率和市场资产组合两个点

D:资本市场线是可达到的最好的市场配置线

答案: 【资本市场线也叫作证券市场线

】

第七章 单元测试

1、单选题:

A group of individuals got together and purchased all of the outstanding shares of common stock of Moutai Inc. What is the return that these individuals require on this investment called? ( )

选项:

A:dividend yield

B:cost of capital

C:cost of equity

D:capital gains yield

答案: 【cost of equity

】

2、单选题:

Textile Mills borrows money at a rate of 13.5 percent. This interest rate is referred to as the: ( )

选项:

A:capital gains yield.

B:compound rate.

C:current yield.

D:cost of debt.

答案: 【cost of debt.

】

3、单选题:

The average of a firm’s cost of equity and aftertax cost of debt that is weighted based on the firm’s capital structure is called the: ( )

选项:

A:weighted capital gains rate.

B:weighted average cost of capital.

C:structured cost of capital.

D:reward to risk ratio.

答案: 【weighted average cost of capital.

】

4、单选题:

The cost of equity for a firm: ( )

选项:

A:ignores the firm’s risks when that cost is based on the dividend growth model.

B:equals the risk-free rate plus the market risk premium.

C:tends to remain static for firms with increasing levels of risk.

D:increases as the unsystematic risk of the firm increases.

答案: 【ignores the firm’s risks when that cost is based on the dividend growth model.

】

5、单选题:

A firm’s overall cost of equity is: ( )

选项:

A:generally less than the firm’s aftertax cost of debt.

B:highly dependent upon the growth rate and risk level of the firm.

C:is generally less that the firm’s WACC given a leveraged firm.

D:unaffected by changes in the market risk premium.

答案: 【highly dependent upon the growth rate and risk level of the firm.

】

6、多选题:

The dividend growth model can be used to compute the cost of equity for a firm in which of the following situations?( )

选项:

A:firms that pay an increasing dividend

B:firms that pay a decreasing dividend

C:firms that pay a constant dividend

D:firms that have a 100 percent retention ratio

答案: 【firms that pay an increasing dividend

;firms that pay a decreasing dividend

;firms that pay a constant dividend

;firms that have a 100 percent retention ratio

】

7、多选题:

If a firm uses its WACC as the discount rate for all of the projects it undertakes then the firm will tend to:( )

选项:

A:favor high risk projects over low risk projects.

B:increase its overall level of risk over time.

C:accept some negative net present value projects.

D:reject some positive net present value projects.

答案: 【favor high risk projects over low risk projects.

;increase its overall level of risk over time.

;accept some negative net present value projects.

;reject some positive net present value projects.

】

第八章 单元测试

1、单选题:

下列哪一个理论认为公司的价值与公司的资本结构无关?

选项:

A:资本资产定价模型

B:MM定理命题I

C:有效市场假说

D:MM定理命题II

答案: 【MM定理命题I】

2、单选题:

融资优序理论认为,当企业存在融资需求时,首先选择下列哪种融资方式。

选项:

A:债务融资

B:

内源融资

C:其他都不正确

D:股权融资

答案: 【

内源融资

】

3、单选题:

下列哪个理论可以解释为什么有的企业选择舍弃债务抵税收益而保持较低的负债水平?

选项:

A:融资有序理论

B:其他都不对

C:代理理论

D:财务困境下的权衡理论

答案: 【财务困境下的权衡理论】

4、判断题:

在考虑企业所得税情况的下MM定理研究了债务利息抵税对企业价值的影响。

选项:

A:错

B:对

答案: 【对】

5、判断题:

通常情况下,资本结构指的是短期债务资本和权益资本各占多大比例。

选项:

A:错

B:对

答案: 【错】

第九章 单元测试

1、单选题:

To calculate the adjusted present value, one will: ( )

选项:

A:add the additional effects of financing to the all equity project value.

B:divide the project’s cash flow by the risk-free rate.

C:divide the project’s cash flow by the risk-adjusted rate.

D:multiply the additional effects by the all equity project value.

答案: 【add the additional effects of financing to the all equity project value.

】

2、单选题:

What are the three standard approaches to valuation under leverage? ( )

选项:

A:APV, FTE, and WACC

B:APT, WACC, and CAPM

C:CAPM, SML, and CML

D:APR, FTE, and CAPM

答案: 【APV, FTE, and WACC

】

3、单选题:

A firm has a total value of $500,000 and debt valued at $300,000. What is the weighted average cost of capital if the after tax cost of debt is 9% and the cost of equity is 14%? ( )

选项:

A:12.125%

B:10.875%

C:7.98%

D:11.000%

答案: 【11.000%

】

4、单选题:

The Tip-Top Paving Co. wants to be levered at a debt to value ratio of .6. The cost of debt is 11%, the tax rate is 34%, and the cost of equity for an all equity firm is 14%. What will be Tip-Top’s cost of equity? ( )

选项:

A:14.0%

B:3.06%

C:0.08%

D:16.97%

答案: 【16.97%

】

5、单选题:

A very large firm has a debt beta of zero. If the cost of equity is 11%, and the risk-free rate is 5%, the cost of debt is: ( )

选项:

A:11%

B:15%

C:5%

D:6%

答案: 【5%

】

第十章 单元测试

1、单选题:

某公司的董事会今天下午开会,通过了一项决议,下个月每股派发现金股利1元。就本次股息而言,今天是指以下哪一天?( )

选项:

A:股权登记日

B:股利支付日

C:股利宣告日

D:除息日

答案: 【股利宣告日

】

2、单选题:

下列哪个理论强调了股利发放的重要性,认为企业应该实行高股利分配率的股利政策。( )

选项:

A:税差理论

B:其余都不对

C:股利无关论

D:“一手在鸟”理论

答案: 【“一手在鸟”理论

】

3、单选题:

下列哪个股利政策最具灵活性?( )

选项:

A:低正常股利加额外股利政策

B:剩余股利政策

C:固定股利支付率政策

D:固定股利政策

答案: 【低正常股利加额外股利政策

】

4、判断题:

基于控股股东与中小股东之间的代理冲突考虑,中小股东希望企业采用多分配少留存的股利政策,以防止控股股东对中小股东的利益侵害。( )

选项:

A:错

B:对

答案: 【对】

5、判断题:

增发股利一定向股东和投资者传递了好消息。( )

选项:

A:错

B:对

答案: 【错】

第十一章 单元测试

1、判断题:

信用债主要是商业机构发行的债券。( )

选项:

A:对

B:错

答案: 【对】

2、判断题:

融资性贸易属于金融融资。( )

选项:

A:对

B:错

答案: 【错】

3、单选题:

我国企业金融融资的主要品种是( )

选项:

A:地方债券

B:国债

C:利率债

D:信用债

答案: 【信用债

】

4、多选题:

以下哪些融资方式属于利率债?( ):

选项:

A:政策性金融债

B:央行票据

C:国债

D:地方政府债券

答案: 【政策性金融债

;央行票据

;国债

;地方政府债券

】

5、多选题:

以下哪些融资方式属于金融融资?( )

选项:

A:金融租赁

B:网络借贷

C:银行贷款

D:优先股

答案: 【金融租赁

;银行贷款

;优先股

】

第十二章 单元测试

1、判断题:

信息不对称容易引发道德风险和逆向选择。( )

选项:

A:错

B:对

答案: 【对】

2、判断题:

股东大会与董事会的关系是委托代理关系。( )

选项:

A:错

B:对

答案: 【错】

3、单选题:

从一般意义上讲,公司的所有者是全体( )

选项:

A:股东

B:经理

C:董事

D:监事

答案: 【股东

】

4、单选题:

现代企业中,董事会于经理层的关系主要表现为( )

选项:

A:承包经营关系

B:地位相同关系

C:信任委托关系

D:委托代理关系

答案: 【委托代理关系

】

5、多选题:

下列哪些形成“委托代理关系”?

选项:

A:

原告聘请律师,要求期努力办案

B:

选民选举人大代表,要求期真正代表选民利益

C:

公司为设备投保,保险公司与客户签订保单时要求该公司采取必要防盗措施

D:

住户要求房东履行房屋修缮义务

答案: 【

原告聘请律师,要求期努力办案

;

选民选举人大代表,要求期真正代表选民利益

;

公司为设备投保,保险公司与客户签订保单时要求该公司采取必要防盗措施

;

住户要求房东履行房屋修缮义务

】

微信小程序

微信小程序

请先 !